Cryptocurrencies are expected to be the currency of the future, but are also becoming increasingly popular as an investment. It has not been uncommon for prices to fluctuate rapidly in a short period of time, recording higher volatility than stocks or FX.

Why do prices of Cryptocurrencies rise so much? This article provides an overview of possible factors.

If you read this article and understand the background to the rise in the price of Cryptocurrencies, you will be in a better position to invest in the future.

What causes cryptocurrency To rise?

Generally speaking, prices are determined by the balance between supply and demand.

Demand refers to how many people want it, while supply refers to the number in the market, such as the amount of currency. Therefore, if the demand is greater than the supply, the price tends to rise.

Therefore, the following points can be considered as factors that cause Cryptocurrencies to rise in value.

1. demand is expected to grow in the future

The first is when “demand is expected to grow in the future”.

For example, if news of the expected spread of Cryptocurrencies is released, it is expected that more people will buy them in the future, and the price may rise. There may also be a case where an increase in the number of restaurants and retail outlets that accept payments in Cryptocurrencies will increase the demand for Cryptocurrencies and the price will rise.

Furthermore, an increase in the number of people who see the potential in Cryptocurrencies as an investment and start trading them could lead to an increase in demand for Cryptocurrencies, which could lead to a price increase.

2. increased visibility of Cryptocurrencies

The second is a case where Cryptocurrencies become better known.

Prices may also rise when Cryptocurrencies become known in familiar places, for example, when a large company decides to adopt a Cryptocurrency or when they are introduced in a well-known shop.

In particular, news about partnerships with major companies can cause prices to rise. For example, when Ripple (XRP) announced a partnership with US MoneyGram, a major international money transfer company, in January 2018, the price soared by more than 25%.

However, the increased publicity may have the opposite effect on bad news, so it is important to keep this in mind.

3. listing Cryptocurrencies on exchanges

The third is when the company is “listed on a Cryptocurrency exchange”.

There are many exchanges for Cryptocurrencies, both domestic and international, but the more a Cryptocurrency is listed on an exchange with a large number of users, the more likely it is that its price will rise. This is because on exchanges with many users, currencies are more liquid and easier to trade.

Also, when a cryptocurrency is listed on a major exchange, the price tends to rise because the cryptocurrency is more well-known.

4. the impact of Cryptocurrency updates

The fourth is when a Cryptocurrency is ‘updated’.

Cryptocurrencies, including Bitcoin (BTC), have their own developers, who are constantly developing them to improve the speed of money transfers and enhance security. And currencies whose performance and convenience have been improved by updates tend to increase in price accordingly.

A famous example of a currency whose price has soared due to updates is Ethereum (ETH). Ethereum’s price rose from ‘1 ETH = about 5 dollars’ at the time of its release to a maximum of ‘1 ETH = 1,600 dollars’ through a series of updates such as ‘Frontier’, ‘Homestead’ and ‘Metropolis’.

5. supply decreases with Burn

The fifth is when the supply of a currency decreases due to a burn.

Burn, meaning ‘incineration’ in English, refers to the act of reducing the number of Cryptocurrencies already issued and circulating in the market. The aim is to increase scarcity and raise prices by reducing the supply of currency.

Recently, in November 2019, Stellar Lumens (XLM) announced that it had burnt 55 billion tokens, about half of its total supply, which led to a price spike of about 20%.

6. impact of the currency crisis

The sixth is a case of ‘demand for Cryptocurrencies increasing due to the impact of a currency crisis’.

A currency crisis is a phenomenon in which the external value of a country’s Fiat (legal tender) falls sharply in emerging countries where the economic situation is unstable. In countries in a currency crisis, many citizens fear a further decline in the value of their currency and exchange their fiat holdings for dollars or Cryptocurrencies, which are more trusted worldwide.

In some cases, this can lead to a surge in demand for Cryptocurrency assets in countries in a state of currency crisis, which in turn leads to an increase in the value of Cryptocurrency assets. Recently, in November 2019, a Cryptocurrency exchange in Argentina, where the national currency, the peso, continued to plummet, recorded a premium price of approximately USD 12,300 to 1 BTC, more than 32% higher than Bitcoin on exchanges in other countries.

However, price increases due to currency crises often only affect the country concerned, while other countries are mostly unaffected by price fluctuations.

7. trends in on-chain indicators

The seventh is when ‘changes in on-chain indicators affect trader psychology’.

On-chain indicators are indicators that can be used to read information such as the excitement of the blockchain network and trends in the trading of Cryptocurrency (tokens).

An example is outflow, which is one of the on-chain indicators. Outflow refers to the amount of Cryptocurrency flowing from an exchange to an external wallet.

When outflows are high (increasing), it indicates a weak selling trend on the exchange regarding the tokens on the blockchain concerned. This is because this event effectively means that the supply of tokens on the exchanges is decreasing. The mechanism by which the price increases is similar to the process described in section ‘5. Burn reduces supply’.

A detailed explanation of on-chain indicators is given later in this article in the section ‘Trading with on-chain indicators’. We hope you will find it of interest.

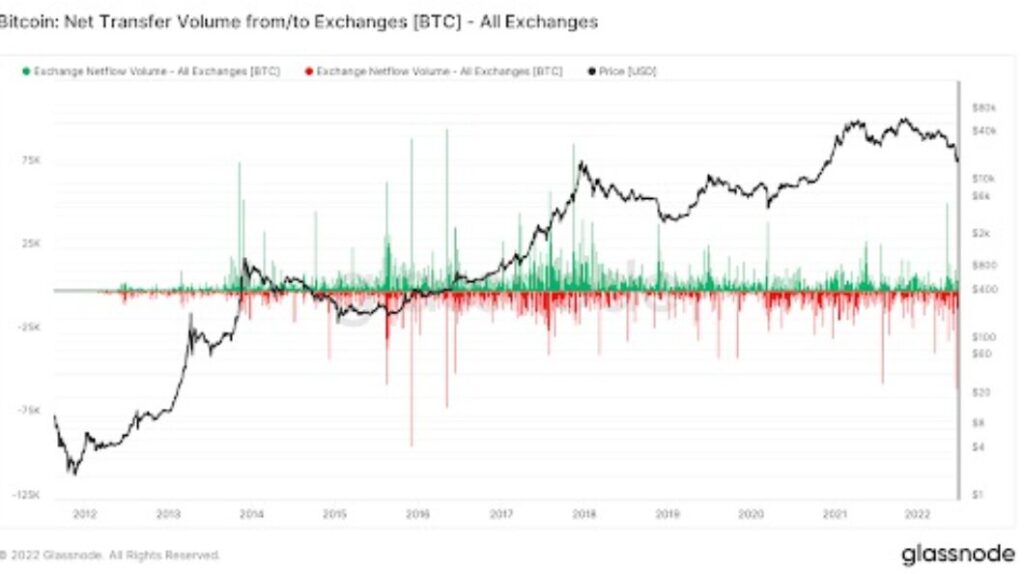

The graph above shows the daily net flows related to bitcoin. A detailed explanation will be provided later in the article, but the red bars in this chart represent an increase in outflows (strictly speaking, a state of dominance relative to inflows).

You can see that from 2015 until around 2017, outflows were noticeably dominant, and then prices started to rise (black line).

Why Is Cryptocurrency Volatile?

Cryptocurrencies are known to be more volatile in price than stocks and forex. The reasons for this may include.

1. low trading volumes

The first is that the volume of trading is low.

Compared to stock investment and FX, fewer people are involved in the Cryptocurrency market, so it only takes a move by a few large investors to affect the overall price. It is also believed that if the number of buyers increases in the future, the overall price will stabilise.

2. no upper limit to price movements per day

The second point is that there is no upper limit to daily price movements.

In the case of stocks, there is an upper limit to daily price movements, called the stop-loss or stop-high limit. This prevents sudden price fluctuations.

In contrast, Cryptocurrencies have no upper limit to daily price movements. When they rise, price fluctuations can exceed those of other financial instruments such as shares.

3. few professional investors

The third point is that there are few professional investors.

It is said that not many professional traders have yet entered Cryptocurrencies. Therefore, compared to stocks and forex, it may be easier for beginners to win.

In addition, if institutional investors enter the market, their influence on the market is significant and may drive up prices.

4. prone to being influenced by national regulations

The fourth point is that they tend to be influenced by national regulations.

Cryptocurrencies are still developing and countries are still searching for regulations and approvals. If there is bad regulatory news for Cryptocurrencies, the price will fall, and if there is good news, such as legislation, the price is likely to rise.

When is the Best Time to Buy Cryptocurrency?

Some of the key points that beginners need to understand as to when to buy Cryptocurrencies include.

1. long-term holdings

The first is that you do not need to be so conscious of the timing of buying and selling if you intend to hold the asset for a long time.

If you are expecting the future potential of Cryptocurrencies and intend to hold them for a long time, you do not need to be that concerned about the timing of buying and selling. If Cryptocurrencies were to rise in price significantly, holding them for several years could yield significant profits.

2. after a fall

The second point is to buy after a fall.

If you are a beginner and do not know when to buy, you can buy at a time when prices are lower, such as after a decline.

If you are able to buy successfully, such as during a temporary decline, you will have obtained a good price in the long run. However, it should be noted that prices may continue to fall.

3. judging by on-chain indicators

The third point is that it is possible to judge investment timing by on-chain indicator trends.

Cryptocurrencies, like gold and stocks, are risk assets, so short-term declines are inevitable. However, Cryptocurrencies have a specific indicator for timing such declines, which utilises on-chain data.

The following section provides more information on this technique.

Using on-chain indicators to trade

Understanding on-chain indicators makes it possible to anticipate price fluctuations to a certain extent. Therefore, a certain number of Cryptocurrency traders utilise on-chain indicators to make investment decisions.

The following commentary will help you to correctly understand the on-chain indicators, which are indicators specific to Cryptocurrency investment, and to use them as a basis for making decisions when investing in Cryptocurrency.

What are on-chain indicators?

On-chain indicators are indicators that allow you to read trends in the network, such as how the excitement, growth and usage trends of the blockchain network are developing.

This brings to mind the question: what is on-chain in the first place?

Put simply, on-chain refers to the specification itself, where transactions such as the transfer of Cryptocurrency are executed and processed on the blockchain. The data in which such transactions are recorded is called on-chain data.

Incidentally, the term on-chain is derived from the English On-chain, which has the nuance of ‘on top of the blockchain (specification)’.

Specific examples of on-chain indicators

Although we have given an overview of on-chain indicators above, it may still be difficult to visualise on-chain indicators.

To solve this problem, we would like to illustrate one of the on-chain indicators, “Bitcoin’s active addresses”, below, together with a graph showing the time-series transition.

The active address is one of the most basic on-chain indicators in the Bitcoin blockchain network.

This indicator represents the number of bitcoin addresses for which there are records of transfers between wallets (records of transactions issued) within a specific time period.

The graph below shows the time series of active addresses.

The graph above shows the daily net flows related to bitcoin. The data period is 17 August 2011 to 26 June 2022.

The black line represents the logarithmic price change of bitcoin, the green bar chart area represents when the net flow is positive and the red bar chart area represents when the net flow is negative.

Historical data trends show that there are many instances where net flows were significantly positive just prior to the Bitcoin price crash.

Using this example as a reference, we can assume that the next time net flow shows a large positive value, we can make a profit by taking investment actions such as short selling.

To summarise the discussion we have conducted so far, even on-chain indicators do not necessarily represent a cause-and-effect relationship, so it is better to examine their use as a basis for investment decisions. However, it does mean that some indicators have the potential to function as leading indicators regarding future price movements.